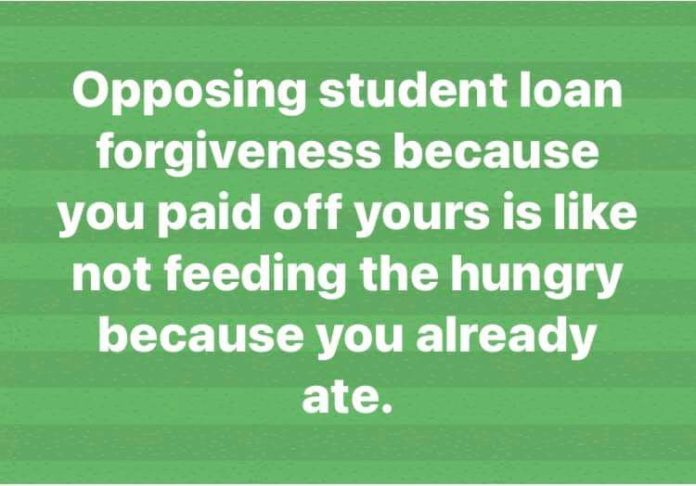

A friend and college classmate of mine recently posted this picture on their Instagram account. My reaction: “how can you compare a voluntary loan agreement with someone starving”? Food versus no food is life or death. Paying off your loans versus whining about the loan you have yet to repay is hard work and living below your means or stealing other people’s money to accomplish the same goal. These two are not even in the same stratosphere in rational comparison. Opposing student loan forgiveness (or any loan forgiveness) is immoral, bad economics, and the mere idea is hard evidence that many people do not understand either.

Student loans are a special and tricky type of loan. Typically loans are agreements between two parties to immediately lend a sum of money with the assurance the loanee will repay the loaner back the sum plus interest over a predetermined time frame. The purpose of the loan, loan amount, interest rate and payment schedule are determined by the loaner as they assess the loanee’s moral and financial integrity. The loanee provides assurances based on savings and past financial soundness to sufficiently convince the loaner to agree to favorable loan terms. This is a voluntarily agreed contract between the two parties. If the loanee does not satisfy their end of the agreement then the loaner is able to seize a sufficient amount of their collateral assets. When it comes to student debt individuals who are 16 through 19 years old do not have significant savings, assets, or past financial soundness to apply for traditional loans. Before 1965 a large portion of college students were able to work while enrolled and graduate without debt or with debt that equated to a small fraction of their annual income. The rest were able to convince private financial institutions or family members for sufficient funds to cover tuition. This was all before Uncle Sam stepped in. But looking back how was that possible? The free market of course. Prospective college students assessed the earning potential with the degree they desired versus the loan terms private institutions were offering. If the math of their cost-benefit analysis did not favorably work out or if they did not want to be burdened with decades of debt repayment following graduation they chose not to go into that agreement. Most people are unaware that in the free market each degree would have a different tuition cost as well as possible loan terms to acquire that degree. This is largely based on the expected post graduation salary and the graduation rate for each degree. For those that did not find this “higher education” situation favorable did not end up at a fast food chain or supermarket for the rest of their lives. They pursued other methods of increasing their skills in exchange for money. That could have been an apprenticeship, working their way up the job ladder, supporting the family business or starting a business of their own to name a few options. What did all of these possible avenues of “high education” have in common? Looking at the individual level: hard work, responsible personal finance, and the accumulation of productive skills that have an obvious and immediate demand in society. From a macroeconomics level this promoted an efficient allocation of resources.

So where did it all go wrong? When did America start to compare student loan debt and a college degree with basic human malnutrition and starvation? Many Americans should already know the answer by now and yet we still have intelligent college graduates suggesting this is a valid analogy. In 1965 the federal government began to guarantee student loans from private financial institutions, as always, with good intentions1. This however, unfalteringly comes back to the Henry Hazlitt concept of the unseen and long term consequences of all economic decisions. The larger the number of people an economic decision affects the larger and longer its negative effects are felt. If one individual practices bad economics or personal finance whether it be a gambling addiction or living above their means the only people who are negatively affected are the individual and possibly their family members. When similar practices are carried out by the government then everyone under that government is negatively affected and the effects are felt at a much higher magnitude. If an individual takes on too much debt then that individual is in serious economic trouble due to their irresponsible personal finance decisions. If the government takes on too much debt then all citizens are in serious economic trouble due to the irresponsible policies from the government and the irresponsible decisions of its citizens who “take advantage” of them. The government can only generate money to reverse these bad economic decisions in two ways: direct taxation and indirect taxation (inflation of the money supply). In 2010 President Obama resolutely cut out the middleman in the student loan process and forced all federal student loans to be filed directly through the Department of Education (DOE). The DOE is, by its very name and nature, unconstitutional but that is a discussion for another day. Individuals can still pursue private student loans however, they will be subject to a variety of loan terms and interest rates which are greatly inflated due to intervention from Uncle Sam. By guaranteeing student loans the government relieves all financial risk from universities from accepting unqualified students and greatly removes risk from the indebted students because they don’t have to repay these loans as it puts their neighbors on the hook. This results in skyrocketing tuition costs and student loan debt. Directly because of this government involvement and subsidization, looking back to the 1993 Higher Education Act, the federal government’s student loan portfolio rose from $353 million in 1993 to $885 billion in 20152. Today, in 2021, the national debt clock for student loan debt stands at $1.72 trillion3. Ultimately, these burdens and bad decisions will come down hard on all citizens whether or not you ever had student loans, through infinite money printing and increased taxes in an attempt to reverse the daunting situation we find ourselves in. Both methods are innately forms of theft.

Back to our horrible food analogy, we can see now that the unsound, economically irresponsible, illegal, and unconstitutional involvement of the government in the student loan market is the primary culprit to our current situation. We now have people who feel they deserve to be rewarded as good academic foot soldiers devoid of all responsibility, work ethic, and sound moral compass. Student loans are not food. Humans do not need a college degree to eat food, earn a living, or be successful. Human progress to higher standards of living, quality of life and happiness most efficiently results from free individuals making calculated decisions to decide what is best for themselves. This will always, in turn, be what is best for humanity as a whole, not government intervention. To achieve this, every individual, especially ones who believe in this false analogy, need to educate themselves in this field and in general human ethics.

Fine way of explaining, and pleasant piece of writing to

take data about my presentation topic, which i am

going to deliver in school.

Thank you. Let me know if you need any other help or resources with your project. contact@goauf.com

Thanks for the article!